Venture Capital Jobs & Tips To Break Into VC - 02

'5 Main Hacks To Stand Out From The Crowd & Break Into VC' - By VC Professional | Top 10 VC Jobs & Internships

Hi👋 VC Crafters, Welcome to today’s VC Crafters’s - Weekly Break Into VC Newsletter - To Get Tactical Advice To Learn, Implement & Craft Path To Venture Capital.

Today At A Glance:

Deep Dive: 5 Main Hacks To Stand Out From The Crowd & Break Into VC

Today’s Top 10 VC Jobs / Internships

Weekend’s Venture Capital & Startups Reading

Inside the Community: Weekly Updates

Join Our 100+ VC Enthusiast Community - VC Crafters To Learn, Network, attend weekly interactive events with VC Working professional and craft your unique path to venture capital.

5 Main Hacks To Stand Out From The Crowd & Break Into VC

One of the most common question I received in my VC Enthusiast community — VC Crafters is “how to stand out from the crowd, to break into VC.”

Honestly — Getting a job in Venture Capital (“VC”) is hard.

The industry is small and very unstructured. Jobs are rarely advertised online and no one really knows where to start.

With more and more people looking to break in every day, you can’t be like everybody else if you want a seat at the table.

💡There are 5 main hacks to stand out from the crowd and break into VC — all of which you can start doing today (in no particular order):

Develop your opinion / thesis about the world

Build your startup portfolio (real or fantasy)

Make yourself seen, by building your personal brand

Start helping founders right away

Don’t ask VCs for a job; provide value instead

Let’s understand each of these hacks and the practical approach on how can you make into it! Also this could be the long post to read, so grab your coffee and let’s deep dive into it!

🤝 If You Are Looking To Break Into VC & Joining the Community of VC Enthusiast to learn, network and craft your path to venture capital. Feel free to check out our VC Enthusiast community — VC Crafters

1. Develop your opinion / thesis about the world

To find a job in VC you will need to find ways to let the firms you’re ‘applying to’ answer the following question positively: “Is this person going to help us to invest in companies that we otherwise would not have invested in without her/him?”

How to do this in a way that is unique to you?

Watch this video from 2010.

The two folks being interviewed are Fred Wilson & John Doerr, two of the most legendary Venture Capitalists from the US. You’ll notice two things about them:

they have incredibly clear opinions, about everything

they are sometimes wrong

And that’s exactly what makes them amazing VCs.

In the same way their well-thought-out opinions sometimes end up being wrong, they sometimes end up being very right. And in VC being right once will make up for being wrong 100 times.

Fundamentally, the role of a VC is to decide where to put money. To do that, you’ll need to have or develop clear and strong opinions about the world, and at the same time adopt the mind of a learner, accepting that you’re wrong most of the time.

Starting to develop your well-thought-out, clear and interesting views of the world today will help you stand out amongst the other 1,000 individuals looking for the same thing as you (a job in VC).

Having clear opinions is easier than you think, because there is a ton of data out there to help you with it. Additionally, you’re betting on the future, not the present. This means that — in the short-term — nothing you’ll come up with as your ‘view on the world’ will be right or wrong. It will just be you. So, let’s get to work!

One of the most important things for a VC is their investment thesis. Defined as “the strategy by which a Venture Capital professional (or fund) makes money for the fund investors”, your thesis will be a guideline / set of principles that will drive your decisions as an investor.

While many investors see their thesis as the ‘group of industries or categories they are interested in’, it doesn’t need to be limited to that. Many VCs have theses about the types of founders they look for and their personalities, the types of business models they like or the geographies they believe are undervalued by other VCs. Having your own thesis (written or very clearly expressed verbally when questioned) can increase your chances of breaking into VC significantly.

✍️ Write Your Own Personal Thesis

You may never end up sending it to anyone as a written file, but I found that writing down your thesis is a fantastic exercise that forces you to dig much deeper into “why you love tech”.

What would you be like as an investor? If you wanted to put money to work, how would you do it and why?

I suggest taking days to do it. Keep updating it every time you get new ideas and you come to new visions of the world as you master the following hacks. The format doesn’t matter. It could be on Google Docs, on Notion, on your laptop’s notes, handwritten in your diary or anywhere you want. What matters is that you make a conscious effort about it.

2. Build Your Startup Portfolio (real or fantasy)

If you’ve not been a VC before, one of the most useful things you can do to break into VC is to show that you were able to invest in some interesting startups, or that you would be good if you were able to invest. Here are two ways to do that, depending on your access to capital:

💰 Build an angel investing portfolio & anti-portfolio

If you have access to capital, I highly recommend you get your feet wet by making a couple of bets before (or during) your attempt at breaking into VC. The beauty of today’s world is that:

You can build an angel portfolio with a limited amount of liquidity: founders these days are open to letting people with small cheques into their rounds as long as they are good friends or bring value to the table.

Platforms are emerging for more and more people to be able to invest. For instance, many people I know started investing in startups through AngelList or other crowdfunding platforms (See Further read 1 for more details). Additionally, anyone today can gain exposure to several startups at the same time by investing in someone else’s fund as an LP through AngelList’s rolling funds.

Whether you decide to invest directly into companies in your network (e.g. companies your friends start), or companies you can find on AngelList or other similar platforms, I suggest being as data-driven as possible, and writing detailed memos about each company you invest in and why you decided to invest in them..

An investor looking to hire you won’t care about how many investments you’ve made or how much money you’ve invested. They will want to see how resourceful you’ve been at finding deals, how carefully / thoughtfully you took those decisions and how good you are at explaining them.

💼 Build your fantasy portfolio

While angel investing can be very helpful to show you have a network (of founders who would let you invest in them or of other investors who would share their deal flow with you), not everyone has the means to invest into startups in their free time.

What I’ve seen work for some friends of mine is the building of a ‘fake portfolio’, or ‘fantasy portfolio’ of investments: essentially pretending to place bets into funding rounds you can read about in the press and then watching the results unfold over time.

Many people have done this publicly, in more & less detail (Examples here, here, here, here & here). Turner Novak’s example is particularly noteworthy as it seems to have helped a lot.

Someone even came up with a website to facilitate the building and tracking of your fantasy portfolio, e.g. Merit, VC101 etc.

No matter what medium you want to use or how you decide to format it, I once again suggest being as data-driven as possible and writing strong memos about each company you end up “investing in” and why you decided to do so.

Most importantly, your fantasy portfolio will need to be non-obvious (e.g. not “I’d have invested in Tesla and Airbnb”). It will need to be made up of unique early-stage companies that didn’t demonstrate much to date; undervalued companies that will trigger anyone’s interest after you explain your reasoning about them.

The data points you’ll be able to gather from public information will likely be scarce, but that shouldn’t discourage you.

All you need to get a somewhat acceptable level of accuracy in your fantasy portfolio tracking is:

Company name

Funding round date

Round size

Round valuation: this is not always disclosed but you can normally get a rough estimate of it by assuming that the company will have given away between 10% and 40% of their company for each financing round and back-solving from there. E.g. Company XYZ just raised a $3M Seed round → if you raise $3M and give away 10%-40% of your company, it means your company is worth between $7.5M and $30M. While this is far from precise, it doesn’t matter for the purpose of this exercise, as all you want to know is whether the company will show a strong growth trajectory in future years (which can normally be inferred by press articles, i.e. about follow-on rounds of financing etc.) and whether therefore you’ve been a good picker or not.

3. Make Yourself Seen, By Building Your Personal Brand

A next step in building up your profile before becoming a VC is to develop your personal brand.

Although not strictly indispensable (as many great VCs are not particularly public people), developing your personal brand and thought leadership can significantly increase your chances of finding your dream VC job, as it will:

make you more visible to VCs, who will be more likely to know about you

make you more desirable in their eyes, since your brand will help them attract more founders and also positively impact their fund’s brand

Today, building a personal brand in the startup world for someone who doesn’t have any investing experience is mostly done through online content.

While creating content may seem scary at first — because you may think you have to find genius things to say or show — it shouldn’t be: many people have became very visible online without adding many new ideas to the world, but just by enriching the content of other people (or democratising it) in intelligent ways.

Personal branding content can take many different shapes. The most important thing is to pick a medium that makes sense to you and that you can have fun with. You could be:

🎤 Hosting A Weekly / Monthly Podcast About A Certain Topic

E.g. my colleague Harry Stebbings started a podcast called The 20 Minute VC from his bedroom when he was 18. Since then, it’s become one of the most valuable media assets in the world of Venture Capital, with some 200,000 subscribers and 80 million downloads to date. It helped Harry build a name in the VC world, become friends with many of the top VCs in the world and launch own VC fund

Here is an article to help you get started: How to Start a Successful Podcast (For Under $100).

🖋️ Writing A Publication or Weekly / Monthly Newsletter

E.g. Sarah Nöckel — now VC at Northzone — started Femstreet, a newsletter for women in tech and venture, back in 2017. It quickly grew to 9,000 free subscribers and recently started monetising. Similarly, Gonz Sanchez started Seedtable in 2019 as a weekly newsletter on European tech for himself and a few friends. It is now read by 12,000+ founders, investors and operators from all across Europe.

Here is an article to help you get started: The Ultimate Guide to Writing Online.

📝 Writing A Few, Heavy-Hitting Articles

You don’t necessarily need a weekly / monthly cadence to build your brand online. Many people have done so by writing a few, heavy-hitting articles or pieces of research that gave them huge visibility.

🐦 Building A Great Twitter Profile with A Strong Following

E.g. Brianne Kimmel — now VC at Worklife — has been building a very strong brand through Twitter (amongst other channels), where she got a lot of visibility in the founder world through educational tweets about the founder journey and about fundraising such as these ones.

Choose a topic that you’re interested in, or know a lot about, and become one of its masters.

Mix things up your own way, and find your way to capture people’s interest, whether it’s through very detailed research, nicely structured summaries of books, unique Twitter threads etc.

You shouldn’t worry about starting big. Content has incredible compounding effects: small steps lead to great outcomes. Even if you start with a very small following and nobody seems to be consuming your content, the process of creating it will build your muscle and knowledge. You can start with very small initiatives or pieces of content and a year later you may suddenly realize you have a blog or podcast. Start today.

No matter what medium you decide to adopt, you should give huge importance to distribution.

Many people spend hours and hours on writing extremely thoughtful articles or Twitter threads or recording podcasts, and then — once those are “out in the real world” — they just wait for engagement to magically happen.

Unless you have dozens of thousands of followers, engagement doesn’t happen that way.

Want to read on other hacks………

4. Start helping founders right away

5. Don’t ask VCs for a job; provide value instead

Join Our 100+ VC Enthusiast Community — VC Crafters to learn, network, collaborate and craft path to venture capital.

Not just this — You will get access to VC Job board, Learning resources, daily discussion session, weekly events, 1:1 call and more.

Subscribed To The “Break Into VC” Newsletter To Get Tactical Advice To Craft Path To Venture Capital!

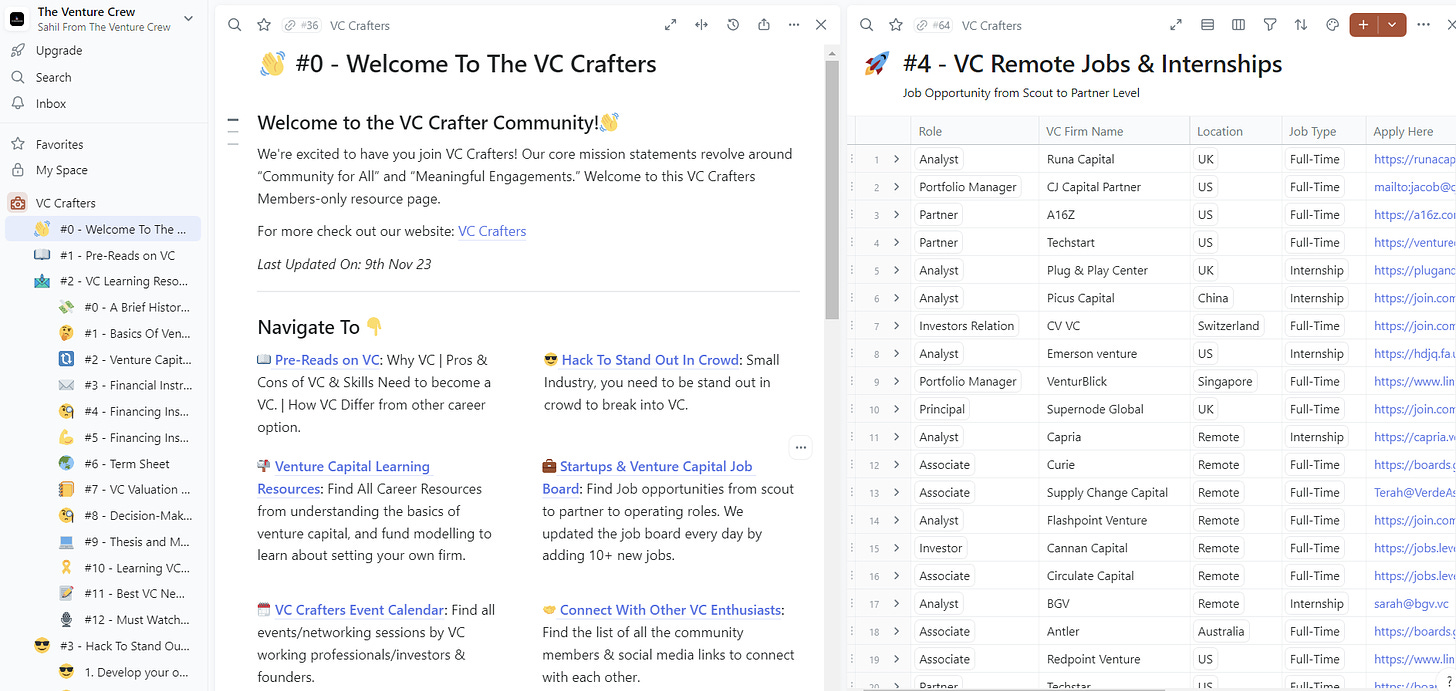

Today’s Venture Capital Jobs & Internship

Head of investors relation - Moderna Venture | USA - Apply Here

Venture Scout - First Momentum Venture | Germany - Apply Here

VC Fellow - Necessary Venture | USA - Apply Here

VC Manager - Octa Venture | USA - Apply Here

Investment Associate - MIG Capital | Germany - Apply Here

Assistant General Counsel - AI Fund | US Remote - Apply Here

Venture Partner - Mindrock capital | Remote USA - Apply Here

Investment Team Intern - Antler | Remote, USA - Apply Here

Investment Associate - Techstars | USA - Apply Here

Investment Summer Associate - In-Q-Tel | USA - Apply Here

Portfolio Impact Associate - Stepstone Venture | USA - Apply Here

Get Access to Curated VC CV/Resume Template - Download Here.

Want to break into VC? Confused about where to start and how to access opportunities?

Join our 100+ VC Enthusiast Community - VC Crafters To Learn, Network, Collaborate & Craft Path To Venture Capital.

Weekends Reading On Venture Capital

Lesser-Known High-Paying Roles in Venture Capital Read Here

Understanding Term Sheet: Finance & Legal Terms Read Here

Understanding Venture Capital Valuations Methods Read Here

How Does Airbnb Build Around Design Thinking? Read Here

“ Y-Combinator Called Me Cockroach During Interview ” Airbnb Founder — Why? Read More

If You Want To Build A Really Big Company, Start A Hard Company. Read Here

Insider The Community

This is just weekly updates on what’s going in the community!

Events: We had call on funding environment in 2024, 2024 trends for portfolio and how to do great market research?

Office Hours Calls: Had a discussion call with four VC enthusiast on CV /profile review, discussion on VC fund modelling and more.

VC Jobs: Shared close to 30 VC jobs in the slack community.

Daily Discussion: Had discussion on various financial instruments like SAFE, convertible note and debt financing.

If you want to be part of this community, feel free to join the community - VC Crafters & Be the part of conversation.

Thank you! Will meet you next week, on Sunday!

✍️Written By Sahil | Join VC Crafter Community